tax avoidance vs tax evasion examples

Crossing that line can lead to hefty fines and prosecution. Hence she decides to save for her retirement in the Savers Credit account.

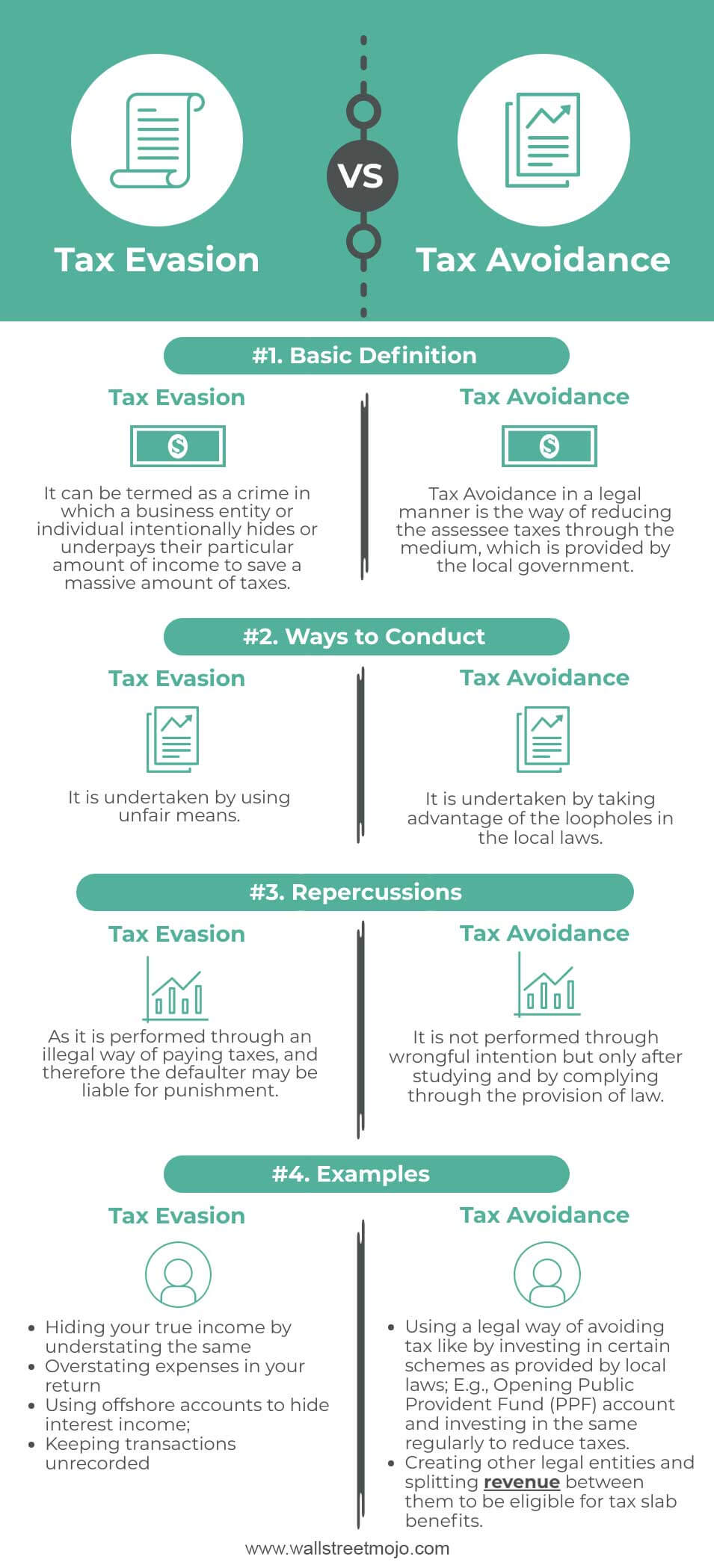

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

For example deductions for mortgage interest are meant to incentivize homeownership and deductions for charitable contributions are designed to incentivize giving.

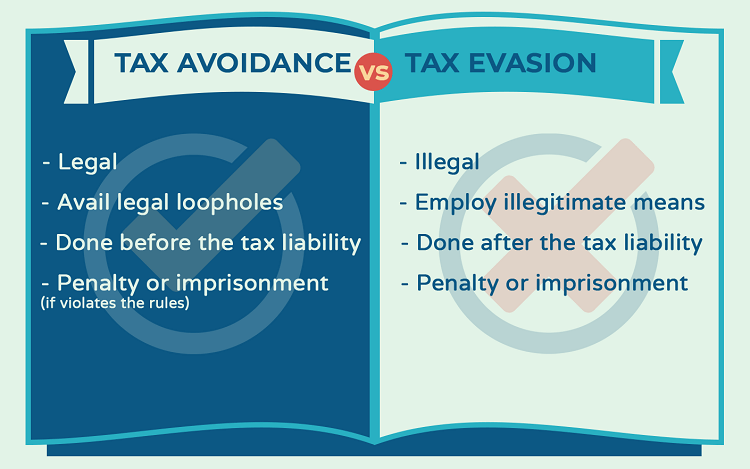

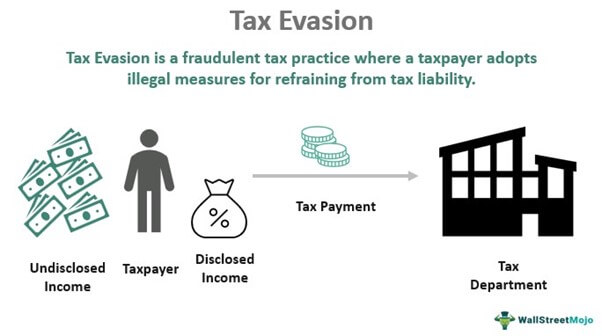

. Tax evasion is when you use illegal practices to avoid paying tax. Select Popular Legal Forms Packages of Any Category. What is tax avoidance vs tax evasion.

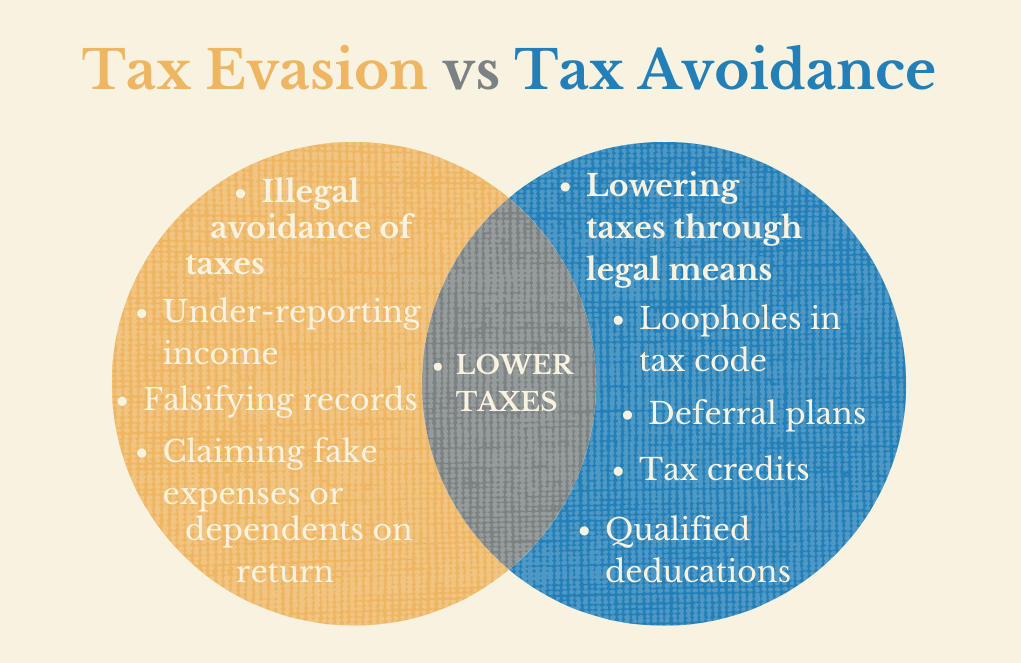

This could include not reporting all of your income not filing a tax return hiding taxable assets from HMRC or using fake offshore accounts. Tax avoidance is taking advantage of credits and deductions and saving for retirement. Tax evasion is often confused with tax avoidance.

Tax evasion includes underreporting income not filing tax returns and purposely underpaying taxes. Tax Evasion Examples Hypothetical Example. If income is not reported by someone authorities do not possess a tax claim on them.

Let us consider the following tax avoidance examples to understand the concept and the process better. Conversely tax evasion is the failure to pay or the intentional underpayment of your taxes. As we know tax evasion is an illegal and unethical practice of an individual or firm to escape from paying fair taxes to the government.

This is a criminal offence and not only can you end up in prison you could also be named and shamed by HMRC if youve avoided. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Tax Avoidance vs Tax Evasion.

Your Role as a Taxpayer Lesson 3. 1 Keeping a log of business expenses. The first one is the evasion of assessment which includes not informing tax authorities of your exact income.

When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax fraud especially in the realm of international and offshore tax aka Tax Evasion. Person determines whether the tax planning activities they are. The Government of any country offers areas and multiple options to the public and entities.

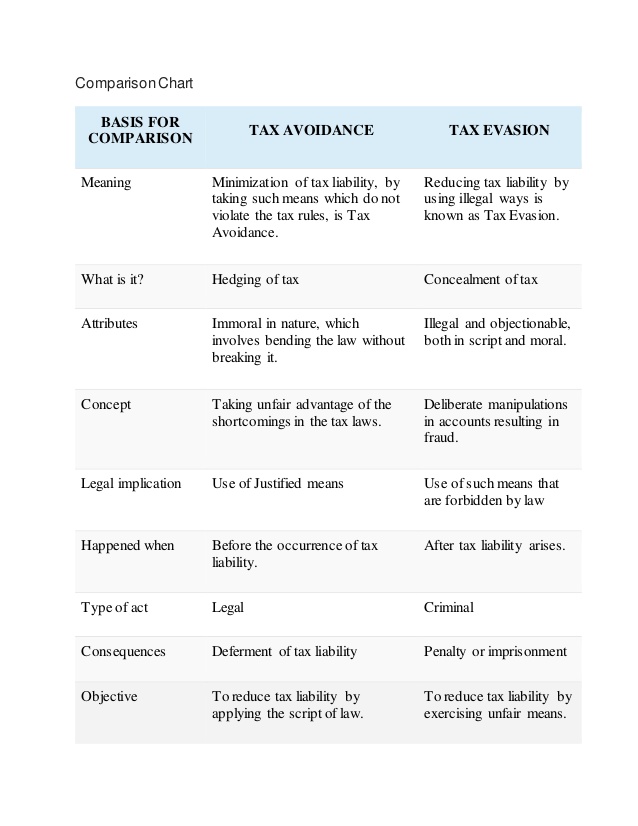

Tax avoidance is different from tax evasion. You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401 k plans. It is undertaken by employing unfair means.

Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1. It is undertaken by taking advantage of loop holes in law. Trust the Attorneys at the Law Offices of Kretzer and Volberding PC.

Tax avoidance is a legitimate practice by which you minimize your tax burden through legal deductions and tax shelters. This includes not paying taxes you owe even though. As a result you need not cheat and get yourself into trouble.

Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. The difference between tax avoidance and tax evasion essentially comes down to legality. To assess your answers click the Check My Answers button at the bottom of the page.

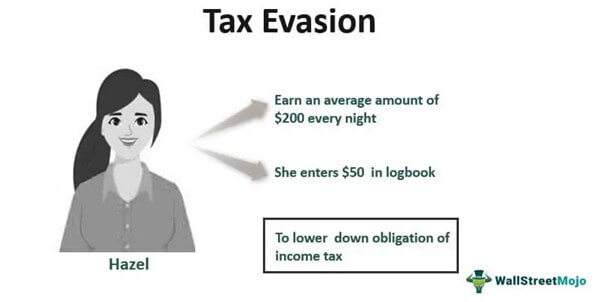

It is a legal strategy that taxpayers can use to legitimately lower their IRS tax bills. Hazel is the server at a very popular Chophouse. The following paragraphs detail what you should know about each concept.

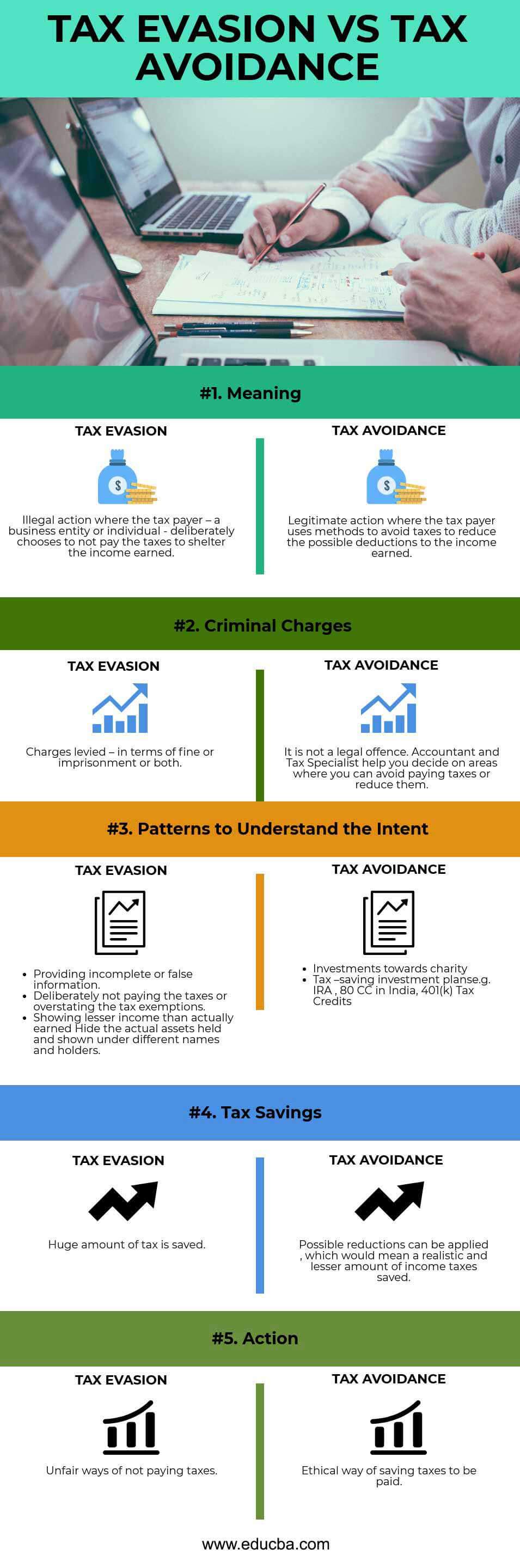

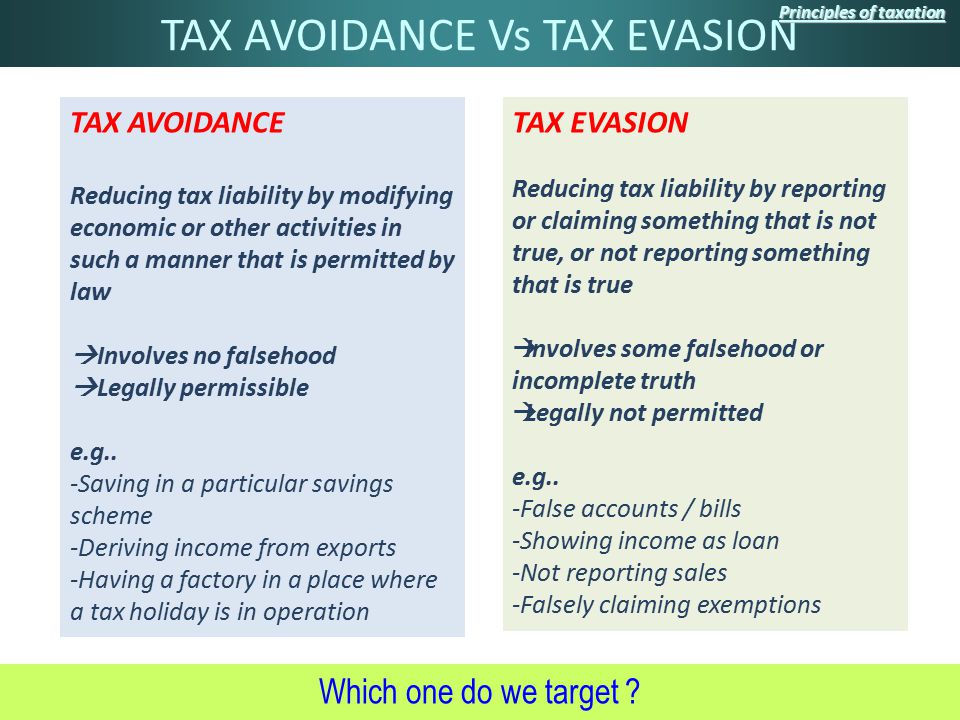

Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. Is tax avoidance legal or illegal. To start with tax avoidance is legal while tax evasion is illegal.

Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. Let us discuss some of the major differences between Tax Evasion vs Tax Avoidance. Tax evasion is the illegal practice of failing to pay taxes report income or even.

However they mean two entirely different things. Tax evasionThe failure to pay or a deliberate underpayment of taxes. Having tax software can help you manage stuff like this legally.

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law. The distinction between tax evasion and tax avoidance to a great extent comes down to two components. Most commonly tax avoidance is done through claiming as many deductions and credits as possible.

We have gathered examples from recent and historic high-profile cases to help you unpick the fine line. Payment of tax is avoided through illegal means or fraud. An example of tax avoidance is a situation where a person owns a business and employs his or her spouse.

Due to the inability to keep records and understand the tax laws many people pay more than essential in state and. On 16 Feb 2022. You wouldnt want to find.

She earns on average an amount of 200 every night through tips. Avoiding tax is legal but it is easy for the former to become the latter. Sarah had an average gross income and is left with a service tenure of 10 years.

If you or a loved one has been accused of tax evasion. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. Underground economyMoney-making activities that.

Tax Evasion vs Tax Avoidance. Youve seen the examples of tax evasion and tax avoidance above. Payment of tax is avoided though by complying with the provisions of law but defeating the intention of law.

This is one of the most common tax evasion examples. Tax evasion can lead to a federal charge fines or jail time. The terms tax avoidance and tax evasion are often used interchangeably.

All Major Categories Covered. Tax avoidance is a legal method of reducing your tax burden by deferring income tax by contributing to an IRA or 401 k claiming legitimate tax deductions or credits and deducting valid business expenses. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

If youre not sure whether something is tax avoidance or tax evasion its best to seek advice from a reputable lawyer andor tax accountant. According to the IRS tax avoidance is an action you can take to reduce your tax liability and therefore increase your after-tax income. The other one is the evasion of payment.

The Taxpayers Responsibilities Key Terms tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Tax evasionThe failure to pay or a deliberate underpayment of taxes. Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed.

Such an approach is called tax avoidance. Tax evasion looks like this. Tax evasion is lying on your personal tax structure or some other structure says Beverly Hills California-based tax.

Tax avoidance is organizing your undertakings with the goal that you pay a minimal measure of tax due. Tax avoidance is structuring your affairs so that you pay the least amount of tax due. Tax Avoidance vs.

The difference between tax evasion and tax avoidance largely boils down to two elements. Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities. Are you unsure of the difference between tax avoidance vs.

There are a series of legitimate ways approved by the IRS to lower your tax bills. Tax Evasion vs Tax Avoidance vs Tax Planning.

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Dsj Cpa

Tax Avoidance Vs Tax Evasion Expat Us Tax

How To Reduce Your Tax Legally And Ethically Ppt Download

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

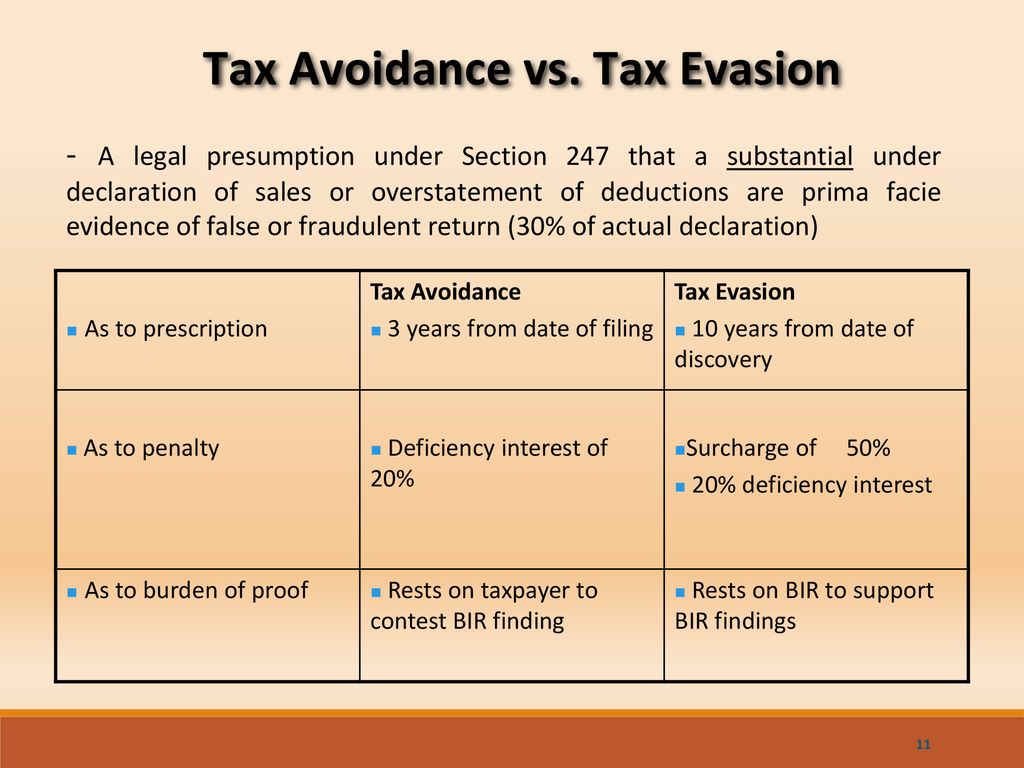

Principles Of Taxation Ppt Download

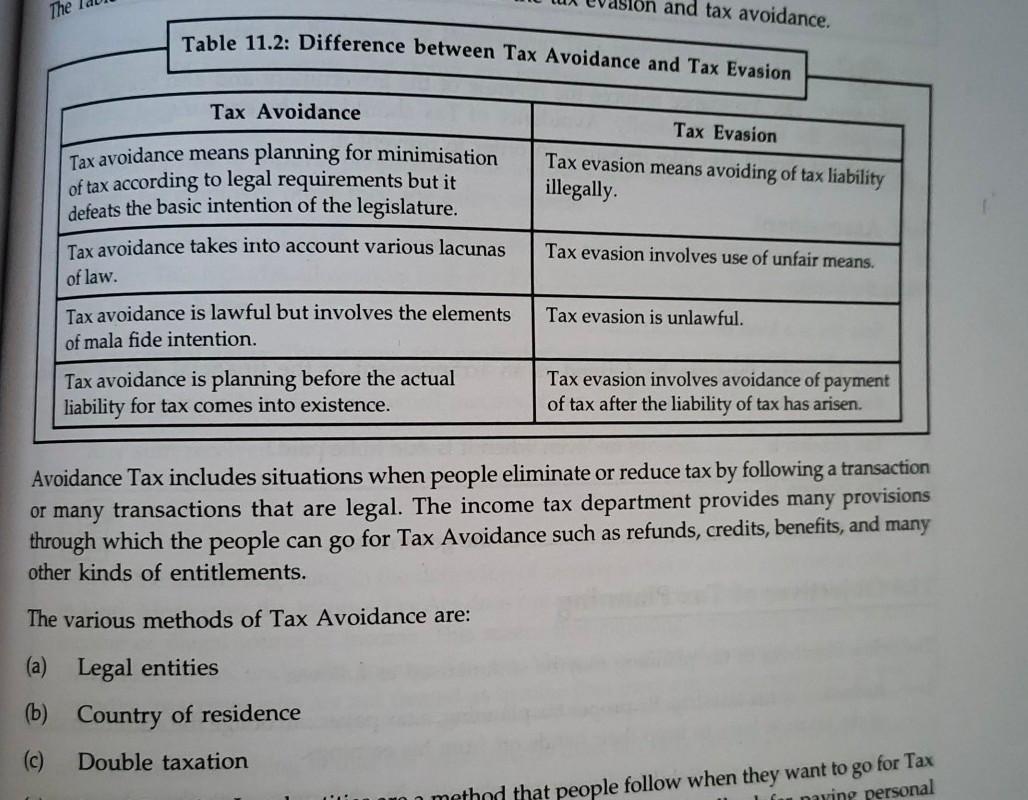

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Tax Evasion Meaning Types Examples Penalties

Differences Between Tax Evasion Tax Avoidance And Tax Planning