tax shield formula canada

For more information about the tax shield see the following pages. This gives you 750 in depreciation for the first six months of ownership.

Gla Amg Suvs Mercedes Benz Middle East

Now lets look at the impact that having debt has on the organizations Income statement which is going to take the form of the interest tax shield.

. Depreciation Tax Shield Formula. Capital Budgeting Formula C Not in the book. Determine the applicable tax rate as per the prevailing tax rates.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Federal income tax rates. Splitting the tax credit If you and your spouse on December 31 of the year covered by the claim want to split the tax shield complete form TP-1029BF-V Tax Shield to calculate the amount each of you will receive.

C If salvage value S is greater than UCC n. Let us take the example of another company PQR Ltd which is planning to purchase equipment worth 30000 payable in 3 equal yearly installments and. Depreciation Tax Shield Sum of Depreciation expense Tax rate.

Present value PV tax shield formula. Interest rates for taxable benefits. This can lower the effective tax rate of a business or individual which is especially important when their reported income is quite high.

C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost. Calculate the amount of Depreciation to be debited to the profit and loss account. This is very valuable to companies.

For example suppose you can depreciate the 30000 backhoe by 1500 a year for 20 years. For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield. Value of the tax shield arising from the disposal of the asset.

So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. Applicable tax rate is 21 and the amount of depreciation that can be deducted is 100000 then the depreciation tax shield.

If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. To learn more launch our free accounting and finance courses. A tax shield is the deliberate use of taxable expenses to offset taxable incomeThe intent of a tax shield is to defer or eliminate a tax liability.

Else this figure would be less by 2400 800030 tax rate as only depreciation would. Depreciation is the normal wear and tear in the asset of the organization. This is usually the deduction multiplied by the tax rate.

Interest Tax Shield Example. Interest Tax Shield Interest Expense Tax Rate. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below.

The tax shield computation is represented by the formula above. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000.

Tax Rate and Tax Shield. The exact amount of the tax shield is determined by adding the work premium and childcare components. The effect of a tax shield can be determined using a formula.

Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect of. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

Canada employment amount 1257 1287 Disability amount 8662 8870 Canada caregiver amount for children under age 18 and addition to spouse common-law partner or eligible. That is why we dont have that line CCA tax shield anymore. The tax rate for the company is 30.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. Calculate the Depreciation Tax Shield from the following formula. Depreciation tax shield 30 x 50000 15000.

Let the undepreciated capital cost of the asset class. All you get from CCA tax shields are the four numbers for each year under CCAT. Multiply your tax rate by the deductible expense to calculate the size of your tax shield.

The tax credit for childcare expenses the work premium and the adapted work premium are the tax credits affected by an increase in income. Tax Shield Sum of Tax-Deductible Expenses Tax rate. PV of CCA tax shield CdTc k d 105k 1k UCCdTc k d 1k n.

4800 8640 6912 and 5530. Depreciation Tax Shield Depreciation Expense Tax Rate. The tax shield strategy can be used to increase the value of a business since it reduces the tax.

For instance we are looking at Bear company that has a 35 tax rate. The remaining asset value at the end of its useful life from the assets purchase price which is subsequently divided by the estimated useful. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

The tax shield formula is simple. The tax shield is a refundable tax credit that offsets a decrease in certain tax credits caused by an increase in your work income. Depreciation Tax Shield Formula.

The amount of UCC depends on the particular circumstances. Consider the following formula for the present value of CCA tax shields. Tax Shield Deduction x Tax Rate.

Therefore XYZ Ltd enjoyed a Tax shield of 12000 during FY2018. Weis summary C If salvage value S is less than UCC n.

Tax Depreciation Definition Eligibility How To Calculate

Netflix S Halston Costume Designer Talks Working With Ewan Mcgregor Wwd

Interest Tax Shield Formula And Excel Calculator

Activists Demand Sexual Violence Against Argentina S Indigenous People Be Classified A Hate Crime Global Development The Guardian

Tax Rates Stripe Documentation

Tax Shield Formula Step By Step Calculation With Examples

Our Virtual Pandemic Year The New York Times

Factors For Selecting The Right Stick Electrode Millerwelds

Tax Shield Formula Step By Step Calculation With Examples

Imputation Tax Meaning How It Works And More Bookkeeping Business Tax Prep Tax

Three Cybersecurity Challenges For Businesses To Address In The Age Of Hybrid Work

Gla Amg Suvs Mercedes Benz Middle East

Tax Shield Formula Step By Step Calculation With Examples

Surprising New Data Shows Comic Readers Are Leaving Superheroes Behind

Lacoste Men S Montreal Black Lacoste Watches For Men Lacoste Best Watches For Men

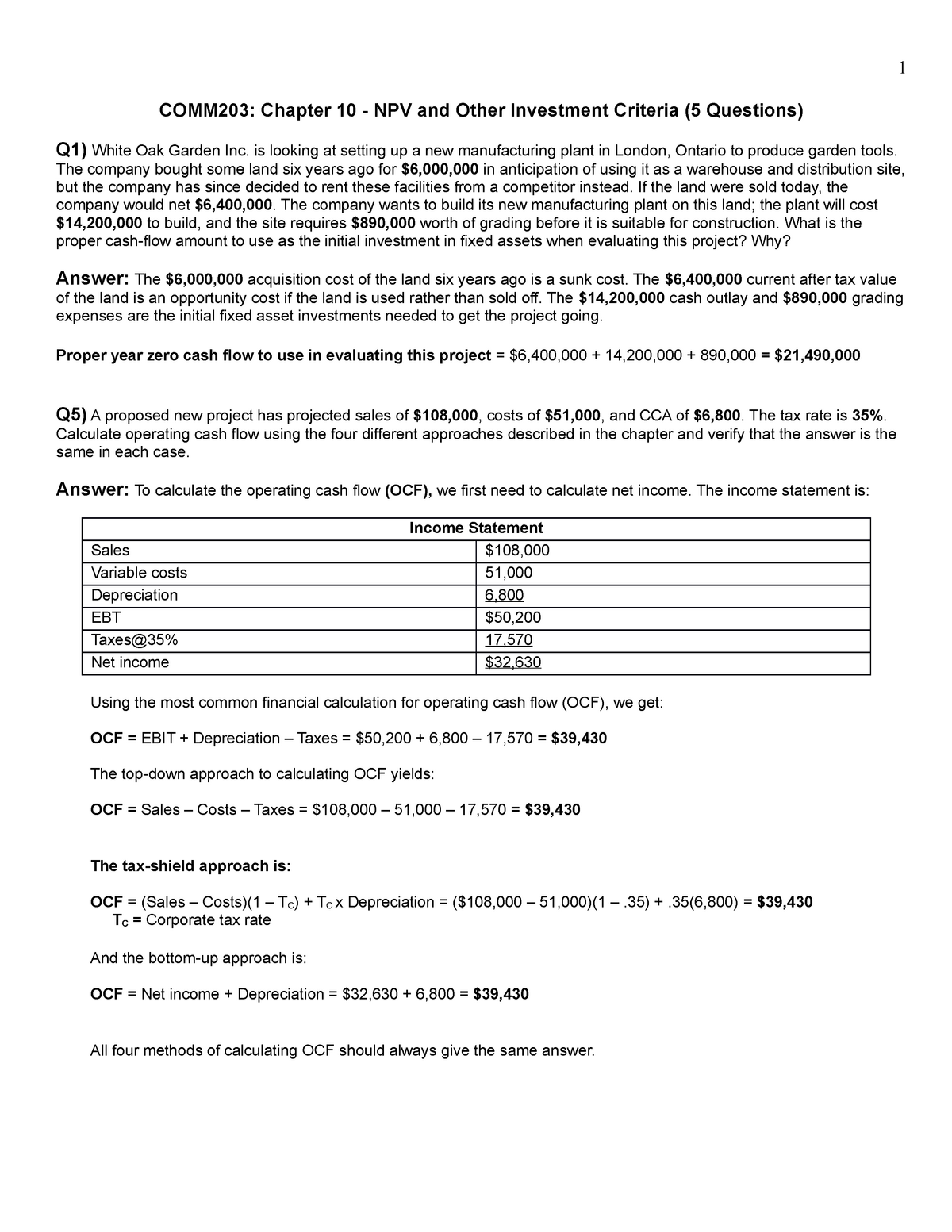

Comm203 Chapter 10 Answers 2 Comm203 Chapter 10 Npv And Other Investment Criteria 5 Studocu

:max_bytes(150000):strip_icc()/conveyor-belt-in-factory-457978597-6dc0d80662994652b10c3e2d0376aaba.jpg)

Capital Cost Allowance Cca Definition Taxes